By Aditi Madan

“There is geometry in the humming of the strings, there is music in the spacing of the spheres.” -Pythagoras

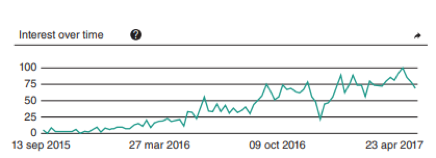

Would you believe that research has shown that certain pieces of music end up being more popular and mainstream due to their ‘mathematical’ structure?

Besides the basic uses of mathematics in music theory and notation (such as chords, time signatures, or dotted half-notes that represent a count of three), music has also been the source of research in many areas of mathematics such as abstract algebra, set theory and number theory. The link between the physical practice of music and strong mathematical abilities are demonstrated in studies that show that kids who play a musical instrument can perform more complex arithmetical operations than those who do not play an instrument. The slow work of practice, the attention to detail and the discipline it takes to learn an instrument are also excellent preparation for the practice involved in building strong math skills.

History of Relationship between Music & Math

Music has long played for performance and pleasure, yet the study of music, particularly its relation to mathematics, has been going on for equally as long as music for performance. From Greeks to Egyptians to Indians to Chinese, nearly every ancient civilized culture has examined the connection between music and mathematics. Famous philosopher Plato was known to have an extreme interest in music, particularly harmonies, and helped highlight their importance within both an individual and society. Plato wasn’t the only philosopher who found the importance of studying the relationship between music and mathematics.

What exactly is the connection between music and mathematics?

It is interesting to note that all fields of music including the Western melodic patterns, the Hindu raga, the Japanese pentatonic scale, etc. conform to a mathematically derived code. This is especially true of Indian classical music where the concept of ‘taal’ or metre, is intrinsically linked to numbers. The connection between the two was never doubted in the past, but rather music and mathematics comprised as a single whole concept. Wayne Parker, senior researcher at Hopkins’s Institute for the Academic Advancement of Youth, comments upon the divide which has emerged between the two. “Today we think in terms of math/science people or verbal/artistic people. There’s that division. In the past, math, music, and reading held the liberal arts together.”

Reiterating this fact is Shankar Mahadevan, famous Indian singer, music director and composer. “I never really connected the dots between music and maths,” says Shankar Mahadevan, who holds an engineering degree in Computer Science from Mumbai University, India. “But maybe learning to play the harmonium and veena before I was five, helped develop my mathematical skills without my realizing it.’

Mathematics in musical instruments

A simple willow flute gives out soothing music, thanks to the mathematics applied while making it. The willow flute is around 50cms in length and has a wooden plug at one end, with a hole at a short distance from the end. The sound is produced by blowing into the flute with varying force while covering the whole hole or a part of it, say one-fourth or half of it. Leaving the end open produces a fundamental tone with its overtones, while keeping it closed produces a different harmonic.

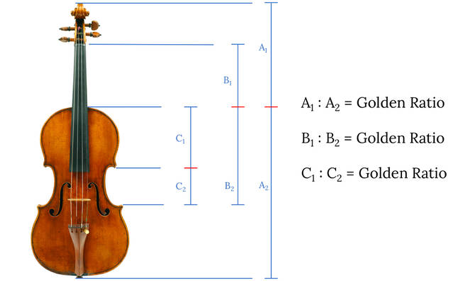

The Fibonacci series consists of a series of numbers in which the present number is the sum of its two preceding numbers. In music, this can be seen in piano scales where the keys form a golden ratio (1.618) – the ratio formed in the Fibonacci sequence.

Violins have four different strings – G, D, A, E. Creating a note involves the string vibrating at their fundamental frequency. The relationship between the fundamental harmonic and the rest of it can be expressed by a sinusoidal equation.

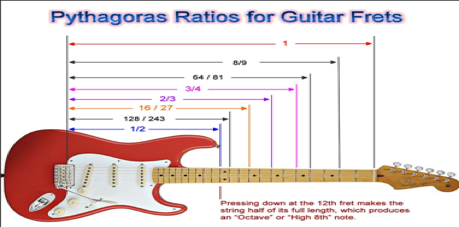

The simplest example is illustrated above with an electric guitar. When a string is played, and then that same string pressed half-way along its length (in the guitar’s case the 12th fret), then we get the same note – this is a whole octave.

Pythagoras and Frequency

It was Pythagoras who realized that different sounds can be made with different weights and vibrations. This led to his discovery that the pitch of a vibrating string is proportional to and can be controlled by its length. Strings that are halved in length are one octave higher than the original. In essence, the shorter the string, the higher the pitch. He also realized that notes of certain frequencies sound best with multiple frequencies of that note. For example, a note of 220Hz sounds best with notes of 440Hz, 660Hz, and so on.

The closest tie between music and math is patterns. Musical pieces often have repeating choruses or bars, similar to patterns. In mathematics, we look for patterns to explain and predict the unknown. Music uses similar strategies. When looking at a musical piece, musicians look for notes they recognize to find notes that are rare (high or low) and less familiar. In this way, notes relate to each other. Relationships are fundamental to mathematics and create an interesting link between music and math.

Wave Frequencies

When we listen to music, we assume that we are hearing a song or a collection of notes, but what our brains are actually processing are sound waves. For example, when a note is played, sound waves travel from an instrument or amplifier and reverberates on our ear drums, and it’s the frequency of this sound wave that tells our brain which pitch or note is being played (e.g. the E above middle C reverberates at approximately 329.63 Hz). Understanding sound waves, particularly the difference between octave notes, requires a bit of mathematics and physics. To find the frequency of a given note, take a constant note (which traditionally is the A above middle C, which contains a frequency of 440Hz) and multiply it by the twelfth root of 2 to the power of the amount of half steps away your desired note is from middle A (if the note is below middle A, make the power a negative). If that confuses you, don’t worry! Below is an example of how to find the frequency of middle C:

- Frequency of Middle C

- = 440Hz * 2 (1/12) to the negative 9th power (middle C is 9 half steps below A)

- =440Hz * 0.59460

- = ~261.625

CONCLUSION

Whatever links between music and mathematics exist, both of them are obviously still very different disciplines, and one should not try to impose one on the other. It would be wrong to attempt explaining all the shapes of music by mathematical means as well as there would be no sense in studying mathematics only from a musicological point of view. However, it would be enriching if these relationships were introduced into mathematical education in order to release mathematics from its often too serious connotations.

It is important to show people that mathematics, in one way, is as much an art as it is a science. This probably would alter its common perception, and people would understand better it essence and universality. This task, however, will certainly not be completed by the end of this century.