By Krisha Shah

InsurTech is the new cool word within the vocabulary of the financial services, replacing the term FinTech, which established itself in the last years of 2000 when companies like Square, Transfer wise, and Stripe accelerated the payments revolution launched by PayPal in the US and Alipay in China. However, I believe that InsurTech does not have yet a clear, agreed, and established definition. So all technologies at the forefront of insurance innovation, such as artificial intelligence, chatbots that enable H2C (Human to Customers) in distribution, as well as advanced analytics that are looking for the right use cases in the data-driven business of insurance, need to fit and find their own space in the definition and concept of InsurTech, which has increased significantly.

Figure 1: InsurTech interest over time based on Google research.

The optimal insurance company has three “employees”: a computer, a dog and an actuary. The computer runs the insurance company, the actuary feeds the dog and the dog bites the actuary if they try to touch the computer. This joke has supposedly been making the rounds among insurtech companies, which are shaking up an industry that has traditionally been slow to adopt new technologies.

There are at least three approaches that characterize the InsurTechs’s way of working:

1. Leverage the most advanced technologies. The most innovative technologies are the core of any InsurTech’s solution. InsurTechs are early adopters of innovative technologies and apply them to the insurance business, develop PoV, productize their solution, and offer it to insurance incumbents often creating the needs and the demand for a specific technology that the insurance business didn’t perceive before. IIt is equally unsurprising that technologies such as auto telematics, drones, or blockchain were brought to the market by InsurTechs rather than insurance incumbents.

2. Focus on improving the experience to foster a user-centric approach. InsurTech entrepreneurs’ focus on improving the experience could be improving the purchasing journey of a customer, supporting underwriters during risk valuation, or helping loss adjusters in the loss assessment. Regardless, the InsurTech obsession is (and must be) improving the experience following a user-centric approach. InsurTechs improve customer centricity by developing new customer value propositions and products that simplify the clients’ user experience in a sector that traditionally lags behind other industries in clarity and usability. The solutions that simplify and improve the underwriting process, the lead allocation mechanisms, and the claims management have an impact on the bottom line as relevant as the one that the InsurTechs focusing on customer experience have on the top line.

3. Have an agile culture and approach and leverage advanced analytics to take business decisions. InsurTech startups are very often developed by technology-driven entrepreneurs who are young and digital natives. . They are not afraid to quickly develop, test, and bring innovations to the market following a lean and agile approach; they embed advanced analytics in their management practices and operations to generate insights and take business decisions on a day-to-day basis.

Why is insurance industry falling?

The Challenge

There is no tangible product delivered within most insurance transactions. The most risk averse individuals will buy it. The least risk averse will self-insure. However, no-one really wants insurance until they really need it. The customer only buys trust – or a promise of trust when times are hard. This tempts intermediaries to sell insurance using the tactics of fear and commoditization. Front-loaded commissions can lead to a tendency to secure sales irrespective of need. This propensity may lead to misrepresentation; it leads to dissatisfaction; temptation leads to fraud; suspicion and a breakdown of trust lead to dysfunctional claims systems; and so it goes. The cycle of fraud in the industry has undermined the true benefits of insurance for a long time. The industry has no product other than trust. If the customer considers the trust to be compromised, there is nothing left. The bigger question is perhaps whether InsurTech needs the incumbents in insurance. Before we address this issue let’s step back and look at how we arrived here.

Digital Transformation in Insurance

1. From non-transparent markets to customer transparency.

In the past, customer market interactions, whether buying services or trading goods, were portrayed by the limited possibility to compare these with local agents or retailers. With the emergence of readily accessible information, this local focus widened and allowed for 24/7 active comparison and competition, e.g. via online direct sales or price comparison sites. In most Business to Customer (B2C) areas, the customer is now also able to validate a purchase intention based on peer reviews, which reduce again, at least perceived, uncertainty. The next level of transparency with the reduction of complexity – the matching of the customer’s available data with an automated customized offering of products – is already market standard for industries like fashion, news, music, and movies.For the insurance industry, especially in the sales of Property and Casualty (P&C) and other standardized products, this means a dramatic shift

2. Substitution of Middle Man – Direct Producer-to-Customer Connection

Digital advancements have allowed companies to offer products and services directly to the customer. Online platforms, ecosystems, and engines are the new middle man and they are substituting (parts of) the traditional supply chain and sales channels. In many industries new players have emerged, especially in retail, such as Amazon, Alibaba, and Rakuten, but also in, for example, aggregating transportation like Uber, Gett, and food delivery, e.g. UberEats and Takeaway.com. Similar mechanisms will occur in the insurance industry. In a world where “online”/“cloud” is nowadays common for the consumer, intermediation will be based on, inter alia, social media profiling; automated recognition of needs; and guided, short, and simple customer data input. Easy to purchase (and cancel) products, direct- and event-based sales, and finally an automated real-time, traceable claims process will substitute the traditional broker.

3. From Many Scattered Players with High Margins to Few Scaled Players with Low Margins

The aggregation of data and automated processes have enabled scalable digital business models that can easily survive with small product margins. Transparency and intermediation transformation has already resulted in fundamental change to many localized, fragmented players like taxi services, lottery, fashion retail, and web services. In insurance, we still see a localized, fragmented market, with many small players scattered across all sectors, nearly all with fully integrated, selfbuilt legacy-heavy value chains. New players are, for example, pure white-label insurance carriers like Element or “insurance factories” like one that can be plugged into their business client’s system with open application programming interfaces (APIs). Their focus will be on core business systems, i.e. underwriting and processing specialized, individual products – ranging from B2C to B2B2C, from unit size one to large scale roll-out – and could accelerate to industry leadership at unprecedented speed.

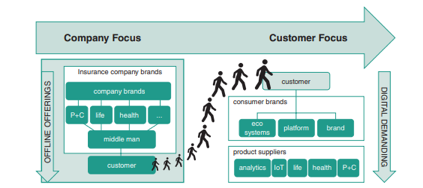

4. From Supply-driven (Company Focus) to Demand-driven (Customer Focus)

This trend aggregates an individual customer-centric focus to the company level. As product purchases will be channelled through, e.g., ecosystems, the primary point of contact and visibility of insurance companies will shift. The impact of focusing on the customer instead of the company is illustrated in Figure 1. Product suppliers, as well as sales, are currently powerful, mostly vertically-integrated, independent units within larger incumbents. However, they will face the impact of becoming supply factories, providing on-demand, efficient services at lowest unit cost. It will be critical to cater to customer demand whenever, wherever, and via whatever intermediation, through diverse but fullyintegrated sales channels (via client relationship management (CRM) systems), whether directly attached to products (e.g. cars, electronics), external plug and play solutions, internal direct sales, or branded ecosystems.

InsurTech now and Going Forward

For many, InsurTech paints the picture of a full-stack insurer that solves and does all I have described as a digitally-native carrier, acquiring customers through the promise of better pricing and experience, while simultaneously giving more than just risk coverage to extract a better customer lifetime value. For me, InsurTech is something broader and may, in some cases, make incumbents invisible and parametric. We may not even recognize a product, technology, or software to be transformative for the insurance industry; the best InsurTech might not be identified as InsurTech at all. Insurance is undergoing an industrial revolution, and, in doing so, all aspects of the value chain will both evolve proactively due to InsurTech, and InsurTech will reactively produce new solutions to serve the ecosystem. Broadly speaking, the taxonomy will follow these pieces of the value chain (distribution, claims, underwriting, and so forth) and the different product lines across life, non-life, and health insurances. However, even this will evolve over time as new buzzwords and new industry-wide trends emerge. As the automobile and mobility industry evolves, so will the corresponding insurance industry.